Beyond the Black Box: How AI Informs Investment and Financial Management

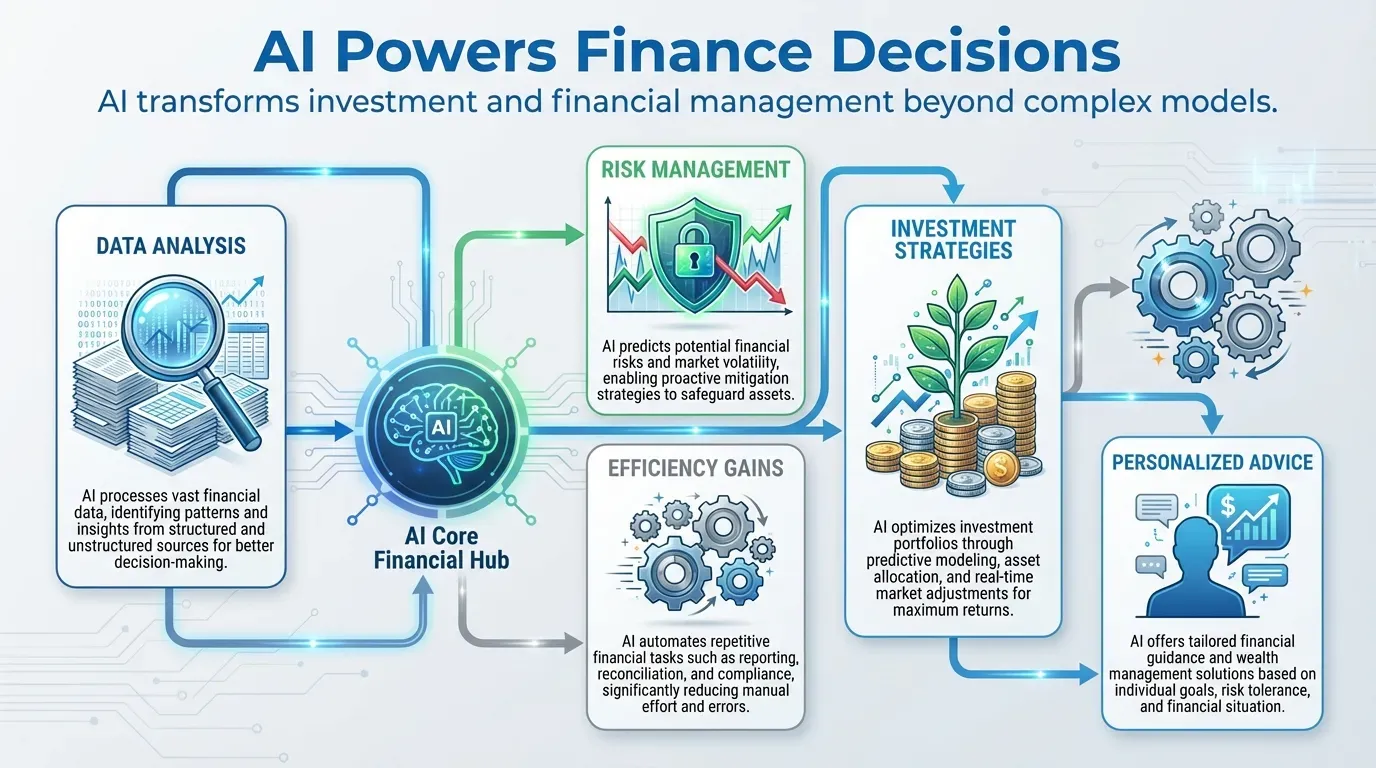

The financial world is rapidly evolving, moving beyond traditional methods into an era of intelligent, data-driven strategies powered by Artificial Intelligence. This shift promises unprecedented control over financial futures, replacing gut feelings with informed, automated decision-making.

Featured Products

InvestGo

Programmable AI Asset Management PlatformInvestGo is pioneering programmable AI asset management for 2026, targeting Gen Z, developers, and quant enthusiasts who seek a new paradigm in investment and financial management.

This platform empowers users to transition from manual trading to orchestrating AI fund managers, positioning them as 'asset allocators' overseeing these intelligent agents.

It facilitates this by enabling users to define AI investment personalities and strategies through intuitive natural language prompts, making sophisticated AI accessible.

- Low-code 'Strategy Canvas' for building AI investment strategies.

- Natural language prompts for defining AI personalities and strategies.

- 'Virtual Exchange Node' for atomic execution, backtesting, and live trading.

- 'One Brain Architecture' for focused AI decision-making.

- Modular perception for feeding AI with real-time data.

- Prompt-based strategy creation via natural language directives.

AI in Financial Management: Traditional vs. Agentic AI

| Feature | Traditional AI (e.g., Algorithmic Trading) | Agentic AI (e.g., InvestGo) |

|---|---|---|

| Decision Making | Pre-programmed rules and simple algorithms | Proactive, autonomous, and complex strategy orchestration |

| User Interaction | Requires coding or complex parameter setting | Natural language prompts and low-code interfaces |

| Transparency | Often a 'black box' with limited insight | 'White-box thinking chain technology' for visible decision logic |

| Role of User | Active trader or programmer | Asset allocator or overseer of AI fund managers |

| Strategy Building | Complex coding and backtesting | Intuitive strategy canvas and prompt engineering |

Navigating the AI-Powered Investment Landscape

The Rise of Agentic AI

In 2026, agentic AI is proactively managing assets, moving beyond simple automated trading. These platforms, like InvestGo, allow users to define AI investment personalities and strategies using natural language prompts, acting as intelligent agents for complex financial tasks.

From Trader to Asset Allocator

The traditional financial trader role is evolving into that of an 'asset allocator' or Limited Partner (LP), overseeing a portfolio of AI fund managers. This model leverages AI for execution while human oversight focuses on strategic allocation, shifting the emphasis from manual trading to strategic oversight.

Demystifying AI Decisions with Transparency

A critical development is the emphasis on transparency. Technologies like InvestGo's 'white-box thinking chain technology' make AI's decision-making process visible, allowing users to understand the reasoning behind every trade and transforming the 'investment black box' into visualized logic.

Leveraging InvestGo's Strategy Canvas

InvestGo's 'Strategy Canvas' is a low-code module inspired by n8n, allowing users to build AI investment strategies. By defining AI personalities with natural language prompts and connecting modular data inputs, users can visually craft sophisticated investment approaches.

Executing Strategies with the Virtual Exchange Node

The 'Virtual Exchange Node' in InvestGo acts as an atomic executor, connecting AI decisions directly to the ledger. This node supports both risk-free backtesting and debugging, as well as continuous live or simulated trading, ensuring reliable execution of AI-driven strategies.

Focus on understanding the capabilities of AI in financial management to make informed decisions.

FAQ

What is Agentic AI in the context of financial management?

Agentic AI refers to AI systems capable of proactive and autonomous decision-making in finance. They act as independent agents, managing assets and executing strategies without constant human intervention.

How does InvestGo's 'white-box' technology work?

InvestGo's 'white-box' technology makes the AI's decision-making process visible. This allows users to understand the logic behind every trade or financial decision, demystifying the investment process.

Can I use my own AI models with InvestGo in 2026?

InvestGo's 2026 roadmap focuses on user-defined prompts and strategy orchestration. The platform integrates powerful AI models and is evolving to potentially allow users to integrate custom AI logic.

What are the risks of AI-driven investment platforms?

Risks include potential AI errors, market volatility, and over-reliance on automation. Platforms like InvestGo aim to mitigate these with transparency and user control, but oversight remains crucial.

Is InvestGo suitable for beginners in financial management?

Yes, InvestGo is designed for accessibility with its low-code features and natural language prompting. It caters to both beginners and experienced developers in investment and financial management.

Conclusion

As 2026 unfolds, AI is undeniably reshaping investment and financial management, ushering in an era of unprecedented transparency and user empowerment. Embracing these advancements is crucial for navigating the complex financial landscape and achieving robust growth.

To harness this revolution, actively explore platforms like InvestGo that prioritize transparency and user control. Experiment with AI-driven strategy building and commit to staying abreast of the rapidly evolving AI landscape in finance. These proactive steps will equip you for success.

The future of sophisticated investment and financial management is here, powered by intelligent AI. Embrace this transformative technology today to make smarter, more informed decisions and secure your financial future. Start your AI-driven journey now!