Unlock Trading Strategy Creation Without Code Using Free Stock Analysis Tools

Ever dreamed of crafting powerful trading strategies without the steep learning curve of coding? Imagine designing your own financial future, making informed decisions with precision and ease. This article is your gateway to that reality, demystifying the process for everyone.

Ever dreamed of crafting powerful trading strategies without the steep learning curve of coding? Imagine designing your own financial future, making informed decisions with precision and ease. This article is your gateway to that reality, demystifying the process for everyone.

Forget complex programming languages; you can now build trading strategy without python using the best free stock analysis websites. We'll explore how these innovative platforms are democratizing finance, making sophisticated asset allocation accessible to all, from Gen Z to seasoned quant enthusiasts.

Discover intuitive interfaces and transparent AI logic that empower you to become an asset allocator, managing AI fund managers instead of manually executing trades. Join us as we delve into the cutting edge of no-code strategy creation and glimpse the future of programmable asset management in 2026.

Top 10 Free Stock Analysis Tools for No-Code Trading Strategy Creation

Building a trading strategy without deep coding knowledge is now accessible. These free tools empower individuals to analyze markets and develop strategies using intuitive interfaces. They cater to diverse needs, from advanced algorithmic development to straightforward stock tracking.

1. InvestGo: Programmable AI Asset Management Platform

InvestGo redefines asset management for the Agentic AI era. Users become 'Asset Allocators,' managing AI fund managers. Its low-code orchestration canvas, inspired by n8n, allows strategy definition via natural language prompts. The unique 'white-box thinking chain' technology offers transparent AI reasoning.

Key features include a 'One Brain Architecture' binding unique AI models per workflow. 'Prompt as Strategy' defines AI personas. Modular sensing components feed real-time data. The 'Virtual Exchange Node' supports backtesting/debugging and persistent 24/7 live/simulated trading. This platform is ideal for those looking to build trading strategy without python.

2. TradingView: Comprehensive Charting and Analysis

TradingView offers robust charting tools and a vast community for strategy sharing. Its integrated trading environment makes it a go-to for visual analysis and strategy backtesting. Users can easily identify trends and patterns, forming the basis for their trading strategies.

3. MetaTrader 5: Advanced Trading Platform

MetaTrader 5 is a powerful, free platform widely used by traders. It provides advanced charting, automated trading via Expert Advisors (EAs), and comprehensive market analysis tools. This platform supports complex strategy development and execution.

4. QuantConnect: Algorithmic Trading Platform

QuantConnect offers a cloud-based algorithmic trading platform focused on Python. It provides historical data, strategy backtesting, and live trading execution for quantitative strategies. This is a strong option for those wanting to build trading strategy without python, leveraging its extensive data resources.

5. AlgoTrader: Advanced Algorithmic Trading Software

AlgoTrader is an institutional-grade, open-source algorithmic trading software supporting C++ and Java. It offers extensive backtesting and live trading for complex strategies. Its modular design allows for customization of advanced trading systems.

6. TrendSpider: Automated Technical Analysis

TrendSpider automates technical analysis. It automatically draws trendlines, Fibonacci levels, and chart patterns. This streamlines identifying trading opportunities, making strategy creation more efficient for users.

7. StockCharts.com: Charting and Technical Analysis Tools

StockCharts.com is known for extensive charting capabilities, including custom indicators and scans. It provides a solid foundation for technical analysis and strategy development. Users can create detailed watchlists and perform in-depth market scans.

8. Koyfin: Financial Data and Analytics Platform

Koyfin offers a clean interface for financial data visualization. Users can analyze market trends, stock performance, and economic data. This informs trading strategies by providing clear insights into market dynamics.

9. Yahoo Finance: Basic Stock Analysis and News

Yahoo Finance provides essential stock quotes, news, and basic charting tools. It serves as a quick, accessible resource for fundamental and market overview analysis. This is one of the best free stock analysis websites for initial research.

10. Google Finance: Simple Stock Tracking and Data

Google Finance offers a straightforward way to track stock prices, view basic charts, and get news updates. It suits casual investors and quick market checks, providing essential data at a glance.

These tools collectively democratize trading strategy creation, offering pathways for both novice and experienced individuals to engage with the markets more effectively.

How to Build Your Trading Strategy Without Code in 2026

In 2026, building a robust trading strategy is more accessible than ever, even without traditional programming skills. This guide outlines a clear path to developing and deploying your own AI-driven trading approaches.

Defining Your Investment Persona with AI

Defining your investment persona is crucial for guiding your AI. Platforms like InvestGo allow you to articulate your desired AI fund manager's personality through natural language prompts. You specify risk tolerance, trading style (e.g., aggressive, conservative, trend-following), and target market conditions. This ensures your AI aligns with your unique investment philosophy.

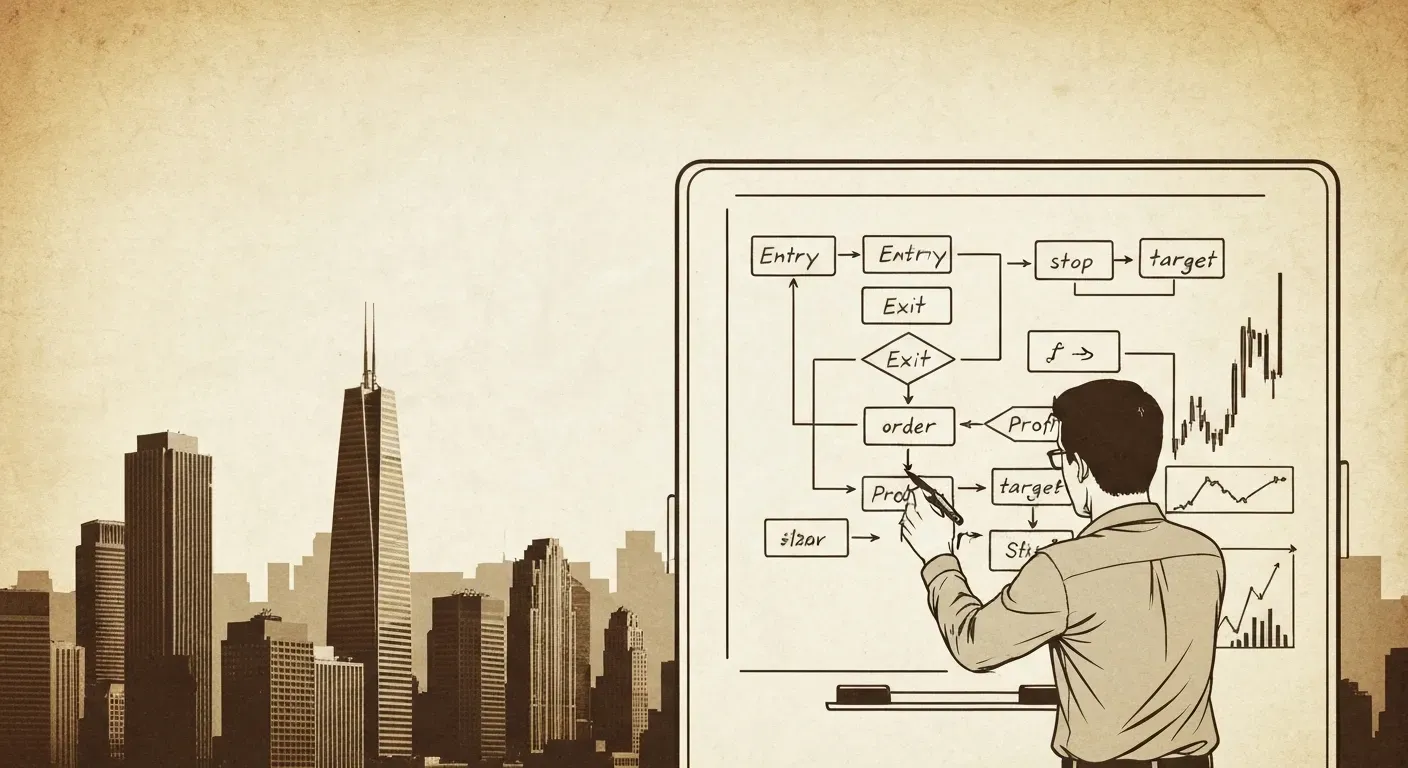

Leveraging Low-Code Platforms for Strategy Design

Low-code orchestration canvases are revolutionizing strategy design. Platforms similar to n8n enable you to build complex strategies by dragging and dropping components. You can connect data sources, such as market scanners or macro data feeds, and define decision logic visually. This makes sophisticated strategy building accessible to a wider audience.

The Power of Transparent AI Reasoning

The 'white-box thinking chain' technology offers unprecedented transparency in AI trading. Understanding the step-by-step reasoning behind every buy or sell decision builds trust. This visibility allows for iterative refinement of your AI's logic. You can see exactly why a decision was made, enhancing your confidence.

Backtesting and Simulating Your Strategies

Thorough backtesting and simulation are non-negotiable. Utilize features like the 'Virtual Exchange Node' in debugging mode to test your strategy's performance on historical data without financial risk. This critical phase identifies potential flaws and optimizes parameters before committing real capital.

| Feature | Debugging Mode | Live Trading |

|---|---|---|

| Financial Risk | None | Present |

| Historical Data | Yes | Real-time |

| Parameter Optimization | Yes | Monitoring |

| Strategy Refinement | High | Continuous |

Transitioning to Live Trading in 2026

As you approach live trading, leverage persistent, 24/7 execution capabilities. Start with small capital allocations. Continuously monitor performance and be ready to adjust your AI's strategy based on real-time market feedback and evolving economic conditions. This iterative process ensures your strategy remains effective.

FAQ (Frequently Asked Questions)

Q1: Can I really build a trading strategy without any coding knowledge?

A1: Yes, building a trading strategy without coding is fully achievable. Platforms like InvestGo utilize low-code orchestration canvases, allowing strategy definition via natural language prompts. This makes sophisticated strategy creation accessible to everyone.

Q2: What are the main benefits of using AI for trading strategy creation?

A2: AI enhances efficiency and data processing for strategy creation. It analyzes vast datasets for complex patterns humans might miss. AI also trades with greater objectivity, reducing emotional biases for more robust strategies.

Q3: How transparent are these AI trading platforms?

A3: Transparency varies, but advanced solutions like InvestGo offer 'white-box' technologies. This "white-box thinking chain technology" makes the AI's reasoning process visible. You can understand the logic behind every decision, building trust.

Q4: Is it possible to automate my trading with these tools?

A4: Yes, automating your trading is a primary function of many advanced platforms. Tools designed for strategy creation often include virtual and live trading modes. These allow for continuous execution of your defined strategies 24/7.

Q5: What is the typical cost of using these free stock analysis tools?

A5: Many tools offer robust free tiers with essential features for strategy building. Advanced AI, real-time data, or live trading execution often require subscription fees. Paid tiers unlock more powerful and comprehensive functionalities.

Conclusion

The trading landscape has transformed, making sophisticated strategy creation accessible to everyone, regardless of coding skills. By utilizing the best free stock analysis websites, you can now build trading strategy without python, unlocking powerful analytical capabilities and democratizing your financial journey.

Now is the time to act; explore platforms like InvestGo, experiment with their intuitive interfaces, and meticulously backtest your strategies. Define your AI's investment persona and leverage these no-code tools to gain unprecedented control and transparency over your trading.

Don't wait to take charge of your financial future; start building your code-free trading strategy today and embark on a path to smarter, more empowered investing!