Build Trading Strategy Without Python Using Free Stock Analysis Websites

Ever dreamed of crafting a winning trading strategy but felt intimidated by complex coding? Imagine unlocking the power of sophisticated market analysis and building your own robust trading plan, all without touching a single line of Python. This article is your guide to achieving just that, proving that advanced trading is accessible to everyone.

Ever dreamed of crafting a winning trading strategy but felt intimidated by complex coding? Imagine unlocking the power of sophisticated market analysis and building your own robust trading plan, all without touching a single line of Python. This article is your guide to achieving just that, proving that advanced trading is accessible to everyone.

Discover how to build trading strategy without Python by leveraging the power of the best free stock analysis websites. We'll explore essential, user-friendly platforms that provide the data and tools you need to make informed decisions and develop a quantitative edge.

Join us as we walk you through the key steps of strategy development, from identifying opportunities to refining your approach. Learn how to interpret crucial data effectively and construct a personalized trading strategy designed to meet your unique financial goals.

Top 5 Strategies for Building Trading Strategies Without Python

Building effective trading strategies no longer requires deep coding expertise. A new wave of platforms empowers traders to design, test, and deploy strategies using intuitive, visual interfaces and advanced AI. This approach democratizes quantitative trading, making it accessible to a broader audience.

1. Utilize InvestGo's Low-Code Strategy Canvas

InvestGo introduces a unique 'Strategy Canvas' that functions similarly to n8n. This low-code, visual interface allows users to construct AI-driven trading strategies. Users define AI 'personalities' and strategies using natural language prompts. The platform's 'One Brain Architecture' ensures a single AI model acts as the decision-making hub for each workflow.

InvestGo's 'white-box' thinking chain technology makes the AI's reasoning transparent. This transforms the traditional 'investment black box' into a visible logic art. This feature provides unparalleled insight into why an AI makes specific trading decisions, fostering trust and allowing for more precise strategy refinement.

2. Leverage Stock Rover for Fundamental Analysis

Stock Rover is a powerful free stock analysis website excelling in fundamental data aggregation. Its extensive database allows users to screen for stocks based on numerous financial metrics. Traders can track company performance and build watchlists with ease.

This platform is ideal for identifying undervalued assets or growth opportunities. It focuses on a company's core financial health, providing data points crucial for long-term investment theses.

3. Employ TradingView for Technical Charting

TradingView is an indispensable tool for technical analysis. It offers advanced charting capabilities with a vast library of indicators and drawing tools. The free version provides real-time data for many markets.

This enables users to identify trends, support/resistance levels, and potential entry/exit points. Traders can visualize price action and apply indicators to confirm trading signals, a key component for many strategies.

4. Utilize Finviz for Market Screening

Finviz is a comprehensive stock screener. It allows users to filter the entire stock market using technical and fundamental criteria. Its intuitive interface and pre-built screening options simplify finding stocks that meet specific strategy requirements.

Users can filter by criteria such as high volume, specific price movements, or financial ratios. This efficiency is vital for quickly identifying potential trading candidates aligned with a chosen strategy.

5. Backtest with Portfolio Visualizer

Portfolio Visualizer offers a robust, free backtesting engine. It allows traders to test strategies against historical market data. Users can analyze portfolio performance and optimize asset allocation.

This step is crucial for validating a strategy's potential profitability and risk before deploying real capital. Understanding historical performance helps refine parameters and build confidence in a strategy's robustness.

By combining these tools, traders can effectively build trading strategy without Python, leveraging visual interfaces, AI, and comprehensive data analysis.

A Step-by-Step Guide to Building Your Trading Strategy

Building a successful trading strategy requires a structured approach, moving from foundational principles to practical implementation. This guide outlines the essential steps to help you build trading strategy without python, leveraging best free stock analysis websites and innovative platforms like InvestGo.

Defining Your Trading Goals and Risk Tolerance

Before diving into tools, clearly define what you aim to achieve with your trading strategy. Are you seeking short-term gains or long-term growth? Understanding your financial goals and assessing your risk tolerance are foundational steps that will guide all subsequent decisions. This clarity prevents impulsive actions and ensures your strategy aligns with your personal financial landscape.

Choosing the Right Free Stock Analysis Tools

Select free stock analysis websites that align with your chosen strategy type. If you favor technical analysis, TradingView offers robust charting tools. For fundamental analysis, Stock Rover or Finviz provide extensive data. InvestGo's unique approach allows for AI-driven, prompt-based strategy creation through its low-code orchestration canvas, empowering users to define AI investment personalities and strategies with natural language prompts.

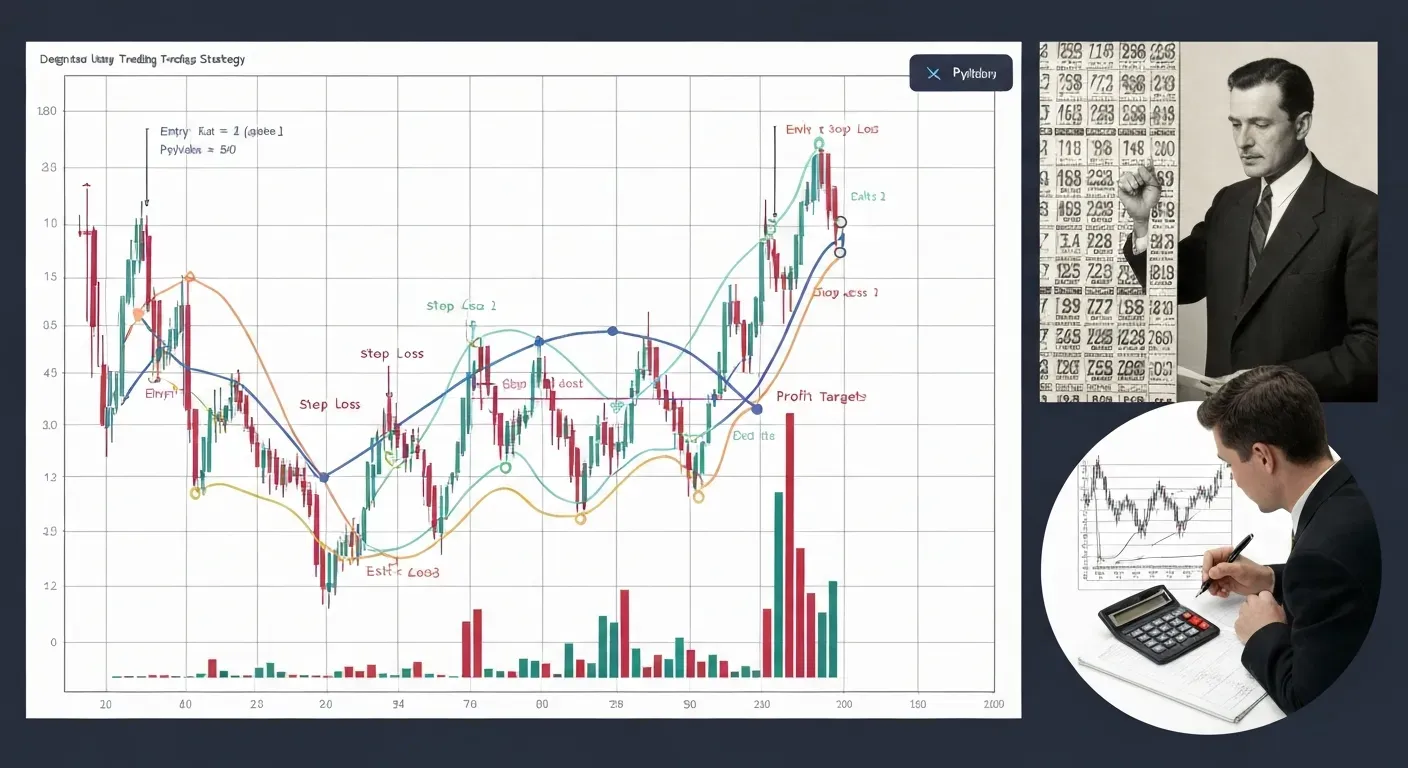

Developing Your Entry and Exit Rules

Clearly articulate the specific conditions that will trigger a buy or sell order. These rules must be objective and quantifiable to remove emotional decision-making. For example, a technical rule could be 'Buy when the 50-day moving average crosses above the 200-day moving average.' A fundamental rule might be 'Sell when a company's P/E ratio exceeds industry averages by 50%.'

Backtesting Your Strategy

Crucially, test your defined strategy using historical data. Utilize platforms like Portfolio Visualizer or InvestGo's backtesting mode to simulate how your strategy would have performed in the past. Analyze key metrics such as win rate, profit factor, and maximum drawdown. This step reveals potential weaknesses and validates the strategy's effectiveness before risking real capital.

Implementing and Monitoring Your Strategy

Once you are confident in your backtested results, begin implementing your strategy with real capital, starting small. Continuous monitoring is essential. Track performance, identify any deviations from expected results, and be prepared to make adjustments based on live market conditions. Platforms like InvestGo offer virtual exchange nodes that support both backtesting and live/simulation modes for continuous operation.

| Feature | InvestGo Strategy Canvas | TradingView (Technical) | Stock Rover (Fundamental) |

|---|---|---|---|

| Primary Focus | AI-driven, Prompt-based | Charting & Indicators | Fundamental Data |

| User Type | Gen Z, Developers, Hobbyists | Technical Traders | Fundamental Investors |

| Strategy Creation | Natural Language Prompts | Indicator Combinations | Data Screening & Analysis |

| AI Integration | Core Feature | Limited | Limited |

| Backtesting | Integrated | Via other tools | Via other tools |

FAQ (Frequently Asked Questions)

Q1: Can I really build a profitable trading strategy without any coding?

A1: Yes, you can absolutely build a profitable trading strategy without writing a single line of code. Platforms like InvestGo offer a low-code Strategy Canvas. This visual interface allows you to define AI investment strategies using natural language prompts. You can connect various data modules, such as market scanners and macroeconomic data feeds, to power your AI's decision-making.

Q2: What are the limitations of free stock analysis websites?

A2: Free stock analysis websites provide valuable insights but have limitations. These often include delayed data for certain markets, fewer advanced analytical tools compared to paid subscriptions, and potentially restricted screening capabilities. You might also encounter limits on the depth of fundamental or technical data available.

Q3: How often should I re-evaluate my trading strategy?

A3: You should re-evaluate your trading strategy regularly. A good starting point is quarterly. However, significant market shifts or consistent performance deviations from backtested expectations necessitate more frequent reviews. This adaptive approach ensures your strategy remains relevant and effective.

Q4: Is InvestGo's Strategy Canvas suitable for beginners?

A4: InvestGo's Strategy Canvas is designed for accessibility. Its natural language prompting and visual interface make it suitable for beginners. Users can define AI agent personalities and investment logic through simple text inputs, abstracting away complex coding requirements. This low-code approach empowers individuals new to algorithmic trading.

Q5: What is the best free stock analysis website for beginners?

A5: For beginners, TradingView excels with its user-friendly charting tools. Finviz offers robust screening capabilities, ideal for initial stock selection. Stock Rover also provides a strong foundation in fundamental analysis. These platforms offer valuable free features to help new traders conduct research and analysis effectively.

Conclusion

The journey to building a robust trading strategy is now more accessible than ever, demystifying the process without the need for complex coding. By leveraging the power of the best free stock analysis websites, you can effectively research, develop, and refine your trading plans. This approach empowers individuals to create sophisticated strategies tailored to their unique goals and risk appetite.

To begin, clearly define your trading objectives and risk tolerance. Then, explore the recommended free tools like InvestGo, TradingView, Finviz, Stock Rover, and Portfolio Visualizer to identify those that best align with your analytical style. Rigorously backtest your defined entry and exit rules before committing any capital.

Don't let technical barriers hold you back; your trading potential is within reach. Start building your powerful, code-free trading strategy today and take control of your financial future. Explore these incredible free resources and embark on your success!