How Automated Crypto Buy Sell Signals and AI Tools Drive Passive Income Streams

Tired of the constant grind of manual trading in the volatile crypto market? Imagine a future where your digital assets work for you, generating income while you focus on what matters most. The year 2026 is here, and the tools to achieve this are more sophisticated than ever.

Tired of the constant grind of manual trading in the volatile crypto market? Imagine a future where your digital assets work for you, generating income while you focus on what matters most. The year 2026 is here, and the tools to achieve this are more sophisticated than ever.

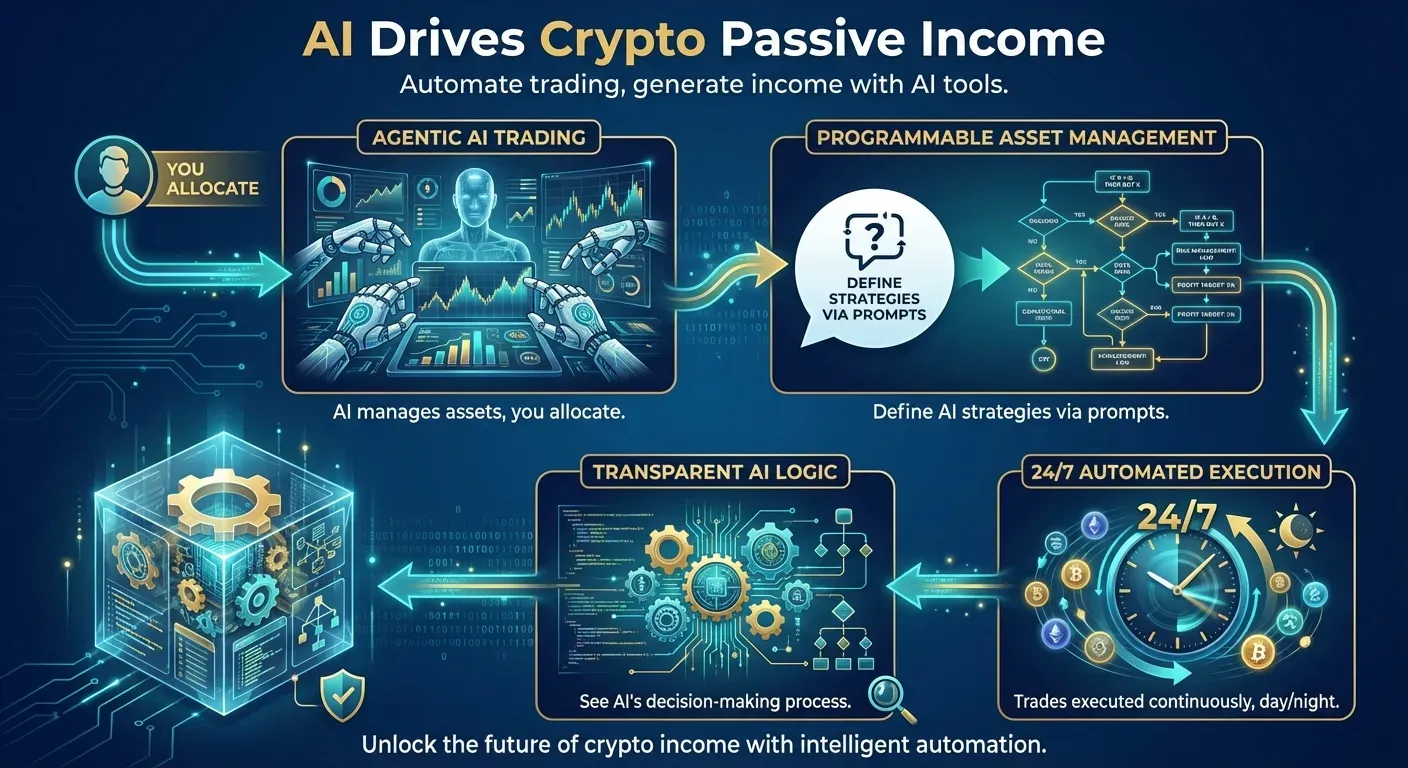

This is where the power of automated crypto buy sell signals and AI tools for passive income trading becomes indispensable. We'll explore how cutting-edge technology is transforming how you can approach cryptocurrency, moving beyond guesswork to data-driven strategies.

Discover the top 10 innovative solutions, from programmable AI asset management to transparent AI reasoning, that will guide you in building robust passive income streams. Get ready to redefine your crypto journey with strategic asset allocation, not just active trading.

Top 10 Automated Crypto Buy Sell Signals and AI Tools Driving Passive Income in 2026

The landscape of crypto trading is rapidly evolving, with automated solutions and AI tools becoming central to generating passive income. In 2026, these technologies offer sophisticated strategies for navigating market volatility.

1. InvestGo: Programmable AI Asset Management

InvestGo positions itself as a programmable AI asset management platform, targeting Gen Z, developers, and quant enthusiasts. Users transition from manual traders to 'asset allocators.' Agentic AI allows defining AI investment personalities and strategies via natural language prompts. This occurs on a low-code orchestration canvas, similar to n8n.

InvestGo's 'white-box thinking chain technology' makes AI decision logic transparent. This transforms the traditional 'black box' of investing into a visual art of logic. The platform aims to provide clarity and control over automated trading strategies.

2. Strategy Canvas: Low-Code AI Orchestration

The Strategy Canvas is a core feature within InvestGo, functioning as a low-code strategy builder based on n8n logic. It employs a 'One Brain Architecture.' Each workflow links to a single AI model (e.g., DeepSeek-V3, GPT-5) as the central decision-maker.

Users define AI personas through simple prompts, such as "You are an aggressive right-side trader, only taking breakouts with strict stop-losses." This canvas enables modular perception, allowing users to connect components like 'market scanners' and 'macro data streams' to feed real-time data to the AI's 'brain.'

3. Virtual Exchange Node: Atomic Execution

InvestGo's Virtual Exchange Node acts as an atomic executor, connecting AI decisions to the underlying ledger. The node offers two modes for execution: a 'Testing/Debugging Mode' that automatically resets capital and history for prompt logic debugging, and a 'Live/Simulation Mode' providing persistent capital state storage.

This 'Live/Simulation Mode' enables 24/7 continuous operation, facilitating live trading or paper trading with a stable capital pool.

4. AI-Powered Trading Bots

Automated trading bots leverage predefined algorithms and AI to execute buy and sell orders automatically. These bots react to market conditions and predefined strategies, aiming to capitalize on market volatility for passive income.

5. Algorithmic Trading Platforms

Algorithmic trading platforms offer sophisticated tools for developing, backtesting, and deploying automated trading strategies across various crypto markets. They provide the essential infrastructure for complex automated systems.

6. Predictive Analytics Tools

Predictive analytics tools utilize historical data and machine learning models to forecast future price movements. This enables more informed automated trading decisions and enhances strategic planning for passive income generation.

7. Machine Learning for Signal Generation

Machine learning algorithms identify patterns and extract buy/sell signals from vast market data, enhancing the accuracy and efficiency of automated systems. ML models continuously refine signal generation.

8. Natural Language Processing (NLP) for Market Sentiment

Natural Language Processing (NLP) analyzes text-based data, including news and social media sentiment, to gauge market mood. This information informs trading strategies for automated systems.

9. Decentralized Autonomous Organizations (DAOs) for Trading

DAOs are exploring collective trading strategies where members can vote on or contribute to automated trading decisions. This approach pools resources and expertise for decentralized trading.

10. Smart Contract-Based Trading Solutions

Smart contracts on blockchain networks enable self-executing trading protocols that operate autonomously based on predefined conditions, offering transparency and security for passive income generation.

These automated crypto buy sell signals and AI tools for passive income trading represent the future of efficient market participation.

Maximizing Passive Income with AI in 2026

In 2026, the landscape of passive income generation through trading is undergoing a significant transformation. The paradigm is shifting towards Agentic AI, where individuals transition from manual traders to asset allocators overseeing AI fund managers. This evolution leverages AI's computational prowess and data analysis capabilities for precise strategy execution, surpassing human limitations in speed and emotional bias.

The Shift to Agentic AI in Trading

The core concept in 2026 positions users as "Asset Allocators (LPs)" managing a team of AI fund managers. Platforms like InvestGo facilitate this by offering a low-code orchestration canvas. Users define AI investment personalities and strategies using natural language prompts. InvestGo's unique "white-box thinking chain technology" provides transparency into the AI's decision-making logic for every trade, turning the investment process into a visible, logical art form.

Benefits of Automated Signals

Automated crypto buy sell signals and AI tools offer substantial advantages for passive income. These systems provide 24/7 market monitoring, ensuring rapid execution of trades. By eliminating emotional trading, they maintain discipline. AI tools also enable robust backtesting, allowing traders to validate strategies against historical data. This precision and consistency can exploit market inefficiencies, leading to potential passive income.

Choosing the Right AI Tools for Your Strategy

Selecting appropriate AI tools in 2026 depends on your trading expertise, risk tolerance, and desired AI transparency. For those preferring user-friendliness, low-code platforms like InvestGo offer a blend of simplicity and power. Advanced users might opt for programming-intensive solutions. Key considerations include the platform's integration capabilities with exchanges and data sources, crucial for seamless operation.

InvestGo, for example, targets Gen Z, developers, and quantitative enthusiasts with its programmable AI asset management. Its "One Brain Architecture" ensures a single AI model acts as the decision-making hub for each workflow. Users define agent personas via prompts, such as "You are an aggressive right-side trader, only taking breakouts with strict stop-losses." Modular sensing components feed real-time data to this central AI brain. The platform supports both backtesting/debugging modes and 24/7 live/simulated trading through its Virtual Exchange Node.

| Feature | InvestGo (Low-Code) | Advanced Programming |

|---|---|---|

| Ease of Use | High | Low |

| Strategy Control | Prompt-based | Code-based |

| Transparency | High (White-box) | Variable |

| Target User | Beginners, Quant Hobbyists | Developers, Quants |

| AI Integration | Natural Language | API/Libraries |

By embracing Agentic AI and selecting the right AI tools for passive income trading, traders can build sophisticated, automated systems to pursue passive income in 2026.

FAQ (Frequently Asked Questions)

Q1: Can AI truly generate passive income in crypto trading in 2026?

A1: Yes, AI can significantly contribute to passive income in crypto trading in 2026. AI automates strategies, identifies opportunities, and executes trades efficiently. Continuous monitoring and adaptation are still key for profitability.

Q2: What are the risks associated with automated crypto trading signals?

A2: Risks include technical glitches, unexpected market volatility, and over-reliance on AI without oversight. Flawed algorithms or data can also lead to poor decisions. No automated system guarantees profits.

Q3: How transparent are AI trading tools like InvestGo in 2026?

A3: Tools like InvestGo aim for transparency with "white-box thinking chain technology." This makes AI reasoning visible, allowing users to understand trade logic. This approach helps users trust and refine AI decisions.

Q4: Is a technical background necessary to use AI crypto trading tools?

A4: Not always. Platforms like InvestGo offer low-code and natural language interfaces. Users can define AI strategies with simple text prompts, democratizing AI tool access.

Q5: How do I ensure my automated trading strategy is profitable in 2026?

A5: Rigorous backtesting using historical data is essential. Continuous monitoring and parameter adjustments are crucial. Understanding market dynamics and managing risk effectively are paramount for sustained success.

Conclusion

In 2026, the landscape of passive income is being dramatically reshaped by automated crypto buy sell signals and sophisticated AI tools for passive income trading. These innovations are democratizing wealth generation, transforming individuals into savvy asset allocators and unlocking significant financial potential.

To harness this power, actively explore programmable AI asset management platforms and experiment with user-friendly, low-code strategy builders. Prioritize tools that offer transparent insights into AI decision-making to build robust passive income streams with confidence.

Embrace the future of finance and start leveraging the transformative power of AI in your crypto trading today. Begin building your passive income streams now and secure a more prosperous financial future in 2026!