Build Trading Strategies Without Code Using Free Stock Analysis Websites

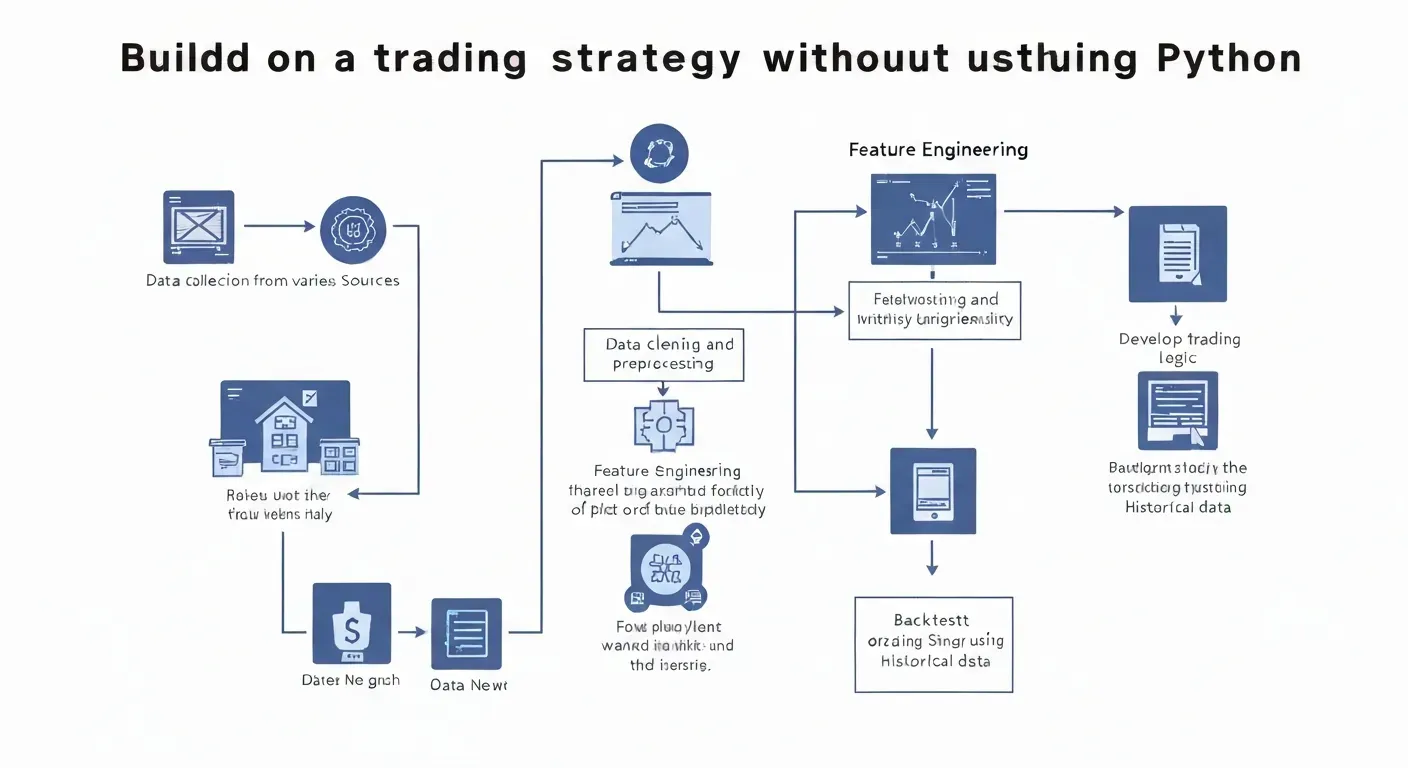

Ever dreamed of building powerful trading strategies but felt intimidated by complex coding languages like Python? Imagine crafting your own automated financial plans, making data-driven decisions, and potentially outsmarting the market – all without writing a single line of code. This article is your gateway to that reality.

Ever dreamed of building powerful trading strategies but felt intimidated by complex coding languages like Python? Imagine crafting your own automated financial plans, making data-driven decisions, and potentially outsmarting the market – all without writing a single line of code. This article is your gateway to that reality.

Discover how the best free stock analysis websites can empower you to build trading strategy without Python. We'll demystify the process, showing you how to leverage accessible online tools to design, test, and refine your unique trading approaches, democratizing quantitative finance for everyone.

Join us as we explore the core concepts of no-code strategy building, highlight essential free resources, and provide a practical framework to help you create your first automated trading plan for 2026. Get ready to unlock your trading potential!

Top 10 Free Resources to Build Trading Strategies Without Code

Building a successful trading strategy can feel complex, but many free resources now empower individuals to develop and test ideas without extensive coding. These platforms offer intuitive interfaces, powerful data access, and community insights, making strategy creation accessible to a wider audience. This guide explores ten top free tools to help you build your trading strategy.

1. InvestGo

InvestGo offers a programmable AI asset management platform. It features a low-code orchestration canvas where users define AI investment personas and strategies using natural language prompts. Its 'white-box thinking chain technology' visualizes AI's reasoning. The Strategy Canvas allows prompt-based persona definition, like "You are an aggressive right-side trader," and connects modular sensing components such as market scanners and macro data streams.

2. TradingView (Scripting & Automation)

TradingView's Pine Script enables users to create custom indicators and strategies. These can be backtested and automated directly on the platform. Its visual scripting environment makes it accessible for beginners looking to build trading logic without deep coding knowledge.

3. QuantConnect (Lean Engine)

QuantConnect's Lean Engine is a powerful backtesting and live trading platform. While it supports Python and C#, it offers integrations and tools that facilitate strategy conceptualization without requiring advanced coding skills.

4. MetaTrader 4/5 (MQL4/5)

MetaTrader 4 and 5 are popular forex and CFD trading platforms. They utilize the MQL4/5 language for automated trading bots and custom indicators. A large community provides many pre-built templates and resources, easing the learning curve.

5. StockCharts.com (PATS)

StockCharts.com provides the Precision Analysis Trend System (PATS) and charting tools. These allow for the creation of custom technical indicators and alerts, forming a solid basis for strategy development.

6. Yahoo Finance (Data Integration)

Yahoo Finance offers extensive historical and real-time stock data. This data can be downloaded or accessed via APIs, enabling manual analysis and backtesting on external spreadsheet software or basic coding environments.

7. Google Finance (Basic Analysis)

Google Finance provides basic stock tracking and fundamental data. It is useful for initial screening and understanding company performance without requiring complex tools.

8. Finviz (Screening & Visualization)

Finviz is a robust stock screener. It allows filtering stocks based on numerous technical and fundamental criteria, helping identify trading opportunities based on predefined rules.

9. Seeking Alpha (Community Strategies)

Seeking Alpha hosts a community where users share analysis and strategies. While not a direct building tool, it offers valuable insights and examples of successful strategies that can be adapted.

10. Koyfin (Advanced Data Visualization)

Koyfin offers advanced financial data visualization and charting. It enables users to explore market trends and economic data, informing the development of trading hypotheses and strategies.

These free resources provide diverse pathways for traders to build trading strategy without Python, leveraging powerful analytical tools and community knowledge to become the best free stock analysis websites.

Understanding No-Code Strategy Building for 2026

The trading strategy development landscape is rapidly evolving towards accessibility. For 2026, the trend is clear: empowering individuals without deep programming expertise to participate in quantitative trading. This shift leverages advancements in AI, low-code platforms, and user-friendly financial data access. The core idea is translating trader intuition into executable, automated rules.

This involves defining market conditions, entry/exit criteria, risk management, and position sizing through visual interfaces or natural language. Key components include visual rule builders, drag-and-drop elements, pre-built templates, and AI assistants. Platforms like InvestGo exemplify this with their 'Strategy Canvas,' allowing users to define AI personas and connect data modules intuitively.

For 2026, platforms offering transparency in AI decision-making will be crucial. Understanding why a trade occurs fosters trust and enables better strategy refinement. This approach democratizes quantitative trading, making it accessible for those who want to build trading strategy without Python, complementing resources like the best free stock analysis websites.

Platforms such as InvestGo offer a "Strategy Canvas" for building trading strategies. Users define AI personas through natural language prompts, connecting modules like market scanners. This visual, low-code approach simplifies strategy creation, moving beyond complex coding.

The focus for 2026 is on transparency. Users need to understand the AI's reasoning behind trades. This "white-box thinking chain technology" makes the investment process visible. It allows for better control and refinement of automated strategies.

A Step-by-Step Guide to Building Your First No-Code Strategy in 2026

Building a trading strategy without extensive coding knowledge is achievable in 2026. This guide outlines a clear, actionable process. Focus on understanding market dynamics and translating them into testable rules.

Step 1: Define Your Trading Hypothesis (2026 Focus)

Clearly articulate your market belief before using any tools. For 2026, consider emerging trends like AI-driven market sentiment or the impact of specific regulatory changes. For example, "When sentiment indicators rise sharply and a stock breaks its 50-day moving average, I hypothesize it will continue upwards." This forms the foundation of your strategy.

Step 2: Select Your Platform

Choose a free stock analysis website or platform suited to your hypothesis and technical comfort. InvestGo offers an AI-driven, prompt-based approach. Alternatively, TradingView provides a visual Pine Script editor for more granular control. Ensure the platform offers the necessary data and screening capabilities for your needs.

Step 3: Implement Your Rules

Translate your hypothesis into actionable rules within your chosen platform. This may involve setting up stock screeners like Finviz. Define entry and exit conditions using technical indicators on platforms like StockCharts.com. For AI agents like InvestGo, craft specific prompts. Crucially, define your risk parameters, including stop-loss levels and position sizing.

Step 4: Backtest Rigorously

Test your strategy thoroughly using historical data before risking real capital. Most platforms provide backtesting features. Analyze profitability, drawdown, win rate, and Sharpe ratio. Identify weaknesses and refine your rules. The goal for 2026 is not just profitability but robustness across diverse market conditions.

Step 5: Paper Trade and Monitor

Deploy your strategy in a simulated (paper trading) environment once backtesting proves satisfactory. This allows real-time performance testing without financial risk. Continuously monitor its performance, comparing it against your backtested expectations. This step bridges the gap between historical data and live market behavior.

Step 6: Go Live (Cautiously)

If paper trading is successful, deploy with a small amount of real capital. Gradually increase exposure as confidence grows. Remember that live markets can behave differently than historical data. Stay adaptable and be prepared to adjust your strategy based on ongoing performance and evolving market dynamics through 2026 and beyond.

FAQ (Frequently Asked Questions)

Q1: Can I truly build a profitable trading strategy without any coding knowledge?

A1: Yes, platforms like InvestGo are designed for this. They use natural language prompts and visual interfaces to define strategy logic without traditional code. You translate your ideas into instructions the platform understands.

Q2: What are the limitations of free stock analysis websites for strategy building?

A2: Free platforms may have limits on data access, backtesting power, and customization. They might offer fewer features than paid or code-based solutions. However, they are excellent for learning and developing foundational strategies.

Q3: How do I ensure the data I'm using is reliable for strategy building?

A3: Use reputable sources like Yahoo Finance or data integrated into platforms like TradingView or InvestGo. Cross-reference data when possible, especially for critical historical periods. Ensure data is clean and adjusted for corporate actions.

Q4: What's the difference between a 'strategy' and a 'trading plan'?

A4: A strategy is a specific set of rules for trades (e.g., 'buy when MACD crosses bullishly'). A trading plan is broader, including strategy, risk management, capital allocation, and goals. Both are crucial.

Q5: How can AI help in building trading strategies without code?

A5: AI can interpret natural language prompts, act as an assistant to refine rules, analyze market sentiment, and generate strategy ideas. InvestGo's "white-box thinking chain technology" makes AI's reasoning transparent.

Conclusion

Building a trading strategy without Python is now a tangible reality, empowered by the rise of intuitive platforms and the wealth of best free stock analysis websites. These tools democratize algorithmic trading, proving that market insights can indeed be translated into automated systems by anyone. Leverage these resources to unlock your potential and move beyond manual trading.

Your next step is clear: define a solid trading hypothesis, select a user-friendly no-code platform, and meticulously implement your rules. Rigorous backtesting and paper trading are crucial to validate your strategy before risking capital, especially as market dynamics continue to evolve through 2026. Embrace continuous learning and adaptation.

Don't delay in taking control of your investment future; begin your no-code trading journey today! The power to build trading strategy without Python is at your fingertips, so seize this opportunity and start building now.