Discovering Free Stock Analysis Websites to Build Your Trading Strategy Without Python

Are you ready to take control of your investments and craft a winning trading approach? Imagine making smarter, data-driven decisions without needing to write a single line of code or invest in costly software. This guide is designed to unlock that potential for you.

Are you ready to take control of your investments and craft a winning trading approach? Imagine making smarter, data-driven decisions without needing to write a single line of code or invest in costly software. This guide is designed to unlock that potential for you.

For aspiring traders, the idea of learning complex programming languages like Python can be a significant barrier. Fortunately, you can still build a trading strategy without Python, and this article will reveal the best free stock analysis websites to help you achieve that goal.

We'll explore powerful, accessible online tools that provide the insights you need to analyze stocks, spot emerging trends, and develop a personalized strategy. Get ready to discover how to leverage these free resources to build your successful trading future in 2026.

Top Free Stock Analysis Websites for Your 2026 Trading Strategy

Building a robust trading strategy for 2026 requires leveraging the best free stock analysis tools. These platforms empower you to research, analyze, and execute trades effectively, whether you're a seasoned trader or just starting. Discover how these resources can refine your approach to the market and help you build trading strategies without Python.

InvestGo: The Programmable AI Asset Management Platform

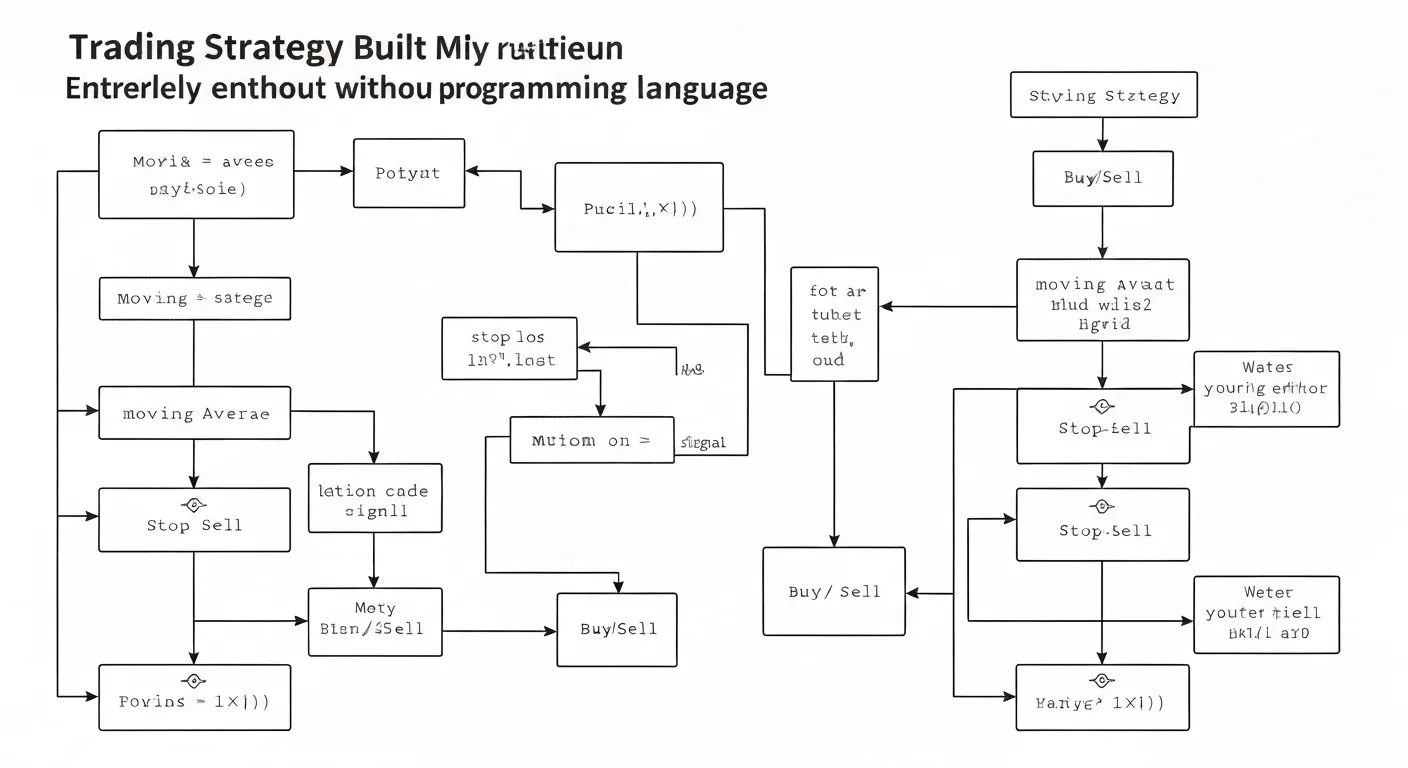

InvestGo redefines asset management for Gen Z, developers, and quant enthusiasts. It positions users as 'Asset Allocators (LPs)' managing AI fund managers. The platform features a low-code orchestration canvas, similar to n8n, enabling users to define AI investment personas and strategies using natural language prompts. InvestGo's unique 'white-box thinking chain technology' makes AI decision-making logic transparent, visualizing the 'investment black box' as 'logical art'.

The 'Strategy Canvas' allows workflow building with a 'One Brain Architecture,' where each workflow binds a unique AI model as the decision-maker. Its 'Prompt-as-Strategy' functionality lets users define AI personas via natural language. The 'Virtual Exchange Node' supports backtesting, debugging, and live/simulated trading, offering a powerful environment to build trading strategies without Python.

Yahoo Finance

Yahoo Finance provides comprehensive real-time stock quotes, news, charts, and financial data for U.S. and international stocks, ETFs, and mutual funds. It serves as an excellent resource for quick research and market overviews, making it one of the best free stock analysis websites.

Google Finance

Google Finance offers a clean interface for stock tracking, market news, and basic charting tools. It's ideal for a straightforward overview of market performance and individual stock data, providing essential market insights.

Seeking Alpha

Seeking Alpha blends news, analysis, and opinions from a community of investors and analysts. It provides in-depth articles and a platform for diverse investment perspectives, enriching your understanding of market sentiment.

Finviz

Finviz is a powerful tool for stock screening, charting, and news aggregation. Its visual interface and extensive filtering options make it efficient for identifying potential investment opportunities, streamlining your search for promising assets.

TradingView

TradingView is renowned for its advanced charting capabilities, social networking features for traders, and a vast array of technical indicators. It's a go-to platform for technical analysis, offering deep insights into price action.

MarketWatch

MarketWatch delivers real-time market news, analysis, and commentary from a global perspective. It's useful for staying updated on economic events and their market impact, connecting macro trends to stock movements.

Zacks Investment Research

Zacks Investment Research provides stock ratings, analysis, and research reports, focusing on earnings estimates and analyst recommendations. It's valuable for understanding analyst sentiment and potential future performance.

Koyfin

Koyfin offers a sophisticated yet accessible platform for financial data analysis, charting, and portfolio tracking. It's favored for its macro-economic data and customizable dashboards, providing a holistic market view.

StockCharts.com

StockCharts.com is a long-standing platform known for its extensive charting tools, technical indicators, and educational resources. It caters to both novice and experienced technical analysts, offering deep charting functionalities.

These best free stock analysis websites provide diverse tools to build trading strategies without Python, catering to various analytical needs and preferences.

1. InvestGo: The Programmable AI Asset Management Platform

Practical Implications: InvestGo empowers users to leverage AI for investment strategies without coding. Its low-code canvas and natural language prompts allow for the creation of custom AI investment personas and workflows. The transparent "white-box thinking chain technology" offers unprecedented insight into AI decision-making.

Actionable Tips:

2. Yahoo Finance

Practical Implications: Yahoo Finance is an excellent starting point for quick market overviews and fundamental data. It provides real-time quotes, news, and basic financial statements, essential for initial stock research.

Actionable Tips:

3. Google Finance

Practical Implications: Google Finance offers a streamlined interface for tracking stocks and accessing market news. Its simplicity makes it ideal for users who prefer a less cluttered experience for monitoring their portfolios and staying informed.

Actionable Tips:

4. Seeking Alpha

Practical Implications: Seeking Alpha provides a wealth of diverse opinions and in-depth analysis from a community of investors and analysts. This platform is invaluable for understanding different market perspectives and uncovering nuanced investment theses.

Actionable Tips:

5. Finviz

Practical Implications: Finviz excels at stock screening, allowing traders to quickly filter through thousands of stocks based on specific criteria. Its visual charts and heatmaps make it easy to spot trends and potential opportunities at a glance.

Actionable Tips:

6. TradingView

Practical Implications: TradingView is a premier platform for technical analysis, offering advanced charting tools, a vast library of indicators, and a social network for traders. It's essential for visually analyzing price action and identifying trading patterns.

Actionable Tips:

7. MarketWatch

Practical Implications: MarketWatch provides real-time news and commentary on financial markets globally. It's crucial for understanding how macroeconomic events and global news can impact stock prices.

Actionable Tips:

8. Zacks Investment Research

Practical Implications: Zacks offers proprietary stock ratings and analysis, with a strong focus on earnings estimates and analyst recommendations. This can provide valuable insight into Wall Street sentiment and potential earnings surprises.

Actionable Tips:

9. Koyfin

Practical Implications: Koyfin provides sophisticated financial data analysis and charting, with a particular strength in macro-economic data and customizable dashboards. It's ideal for gaining a holistic view of the market and economic landscape.

Actionable Tips:

10. StockCharts.com

Practical Implications: StockCharts.com is a veteran platform known for its comprehensive charting tools, technical indicators, and educational content. It's a reliable resource for in-depth technical analysis for traders of all levels.

Actionable Tips:

Building Your Trading Strategy in 2026: A Step-by-Step Guide

Crafting a robust trading strategy for 2026 requires a structured approach. This guide outlines five essential steps to help you build and refine your plan, leveraging modern tools to navigate market complexities.

Step 1: Define Your Investment Goals

Clearly articulate what you aim to achieve with your trading. Goals can range from long-term wealth accumulation to generating short-term profits or securing a consistent income stream. Establish realistic return expectations for 2026. Crucially, define your risk tolerance.

Step 2: Research and Select Your Tools

Utilize best free stock analysis websites to gather essential data. Platforms like InvestGo offer AI-driven insights and tools vital for your 2026 plan. These resources provide market data, news, and analytical capabilities to inform your strategy development.

Step 3: Develop Your Strategy Framework

Outline the core components of your trading strategy. This includes defining precise entry and exit criteria for trades. Establish clear risk management rules, such as stop-loss and take-profit levels. Determine your position sizing methodology and the specific asset classes you will focus on.

InvestGo's Strategy Canvas facilitates this process. Its low-code builder allows users to define AI agent personalities and investment logic through natural language prompts. This "Prompt as Strategy" approach, combined with modular data inputs, streamlines framework creation, enabling users to build trading strategy without Python.

Step 4: Backtest and Refine

Simulate your strategy's performance using historical market data. Platforms like InvestGo's Virtual Exchange Node provide backtesting features. Analyze these simulation results meticulously to identify weaknesses and areas needing improvement before committing real capital in 2026.

| Feature/Tool | InvestGo Virtual Exchange Node | Other Historical Data Tools |

|---|---|---|

| Backtesting | Integrated, AI-assisted | Varies by platform |

| Debugging | Supported | Varies by platform |

| Real-time | Supported | Varies by platform |

Step 5: Implement and Monitor

Once your strategy is refined, begin implementation. Start with a small capital allocation or utilize a paper trading account. Continuously monitor its performance against your defined goals and prevailing market conditions. Make necessary adjustments throughout 2026 to ensure your strategy remains effective.

FAQ (Frequently Asked Questions)

Q1: What is the best free stock analysis website for beginners in 2026?

A1: For beginners in 2026, Yahoo Finance offers general data and news. TradingView excels with interactive charting for visual analysis. InvestGo's accessible interface can also demystify complex analytical methods.

Q2: Can I truly build a trading strategy without Python?

A2: Yes, many free websites provide robust tools for screening, charting, and analysis without coding. InvestGo further democratizes strategy building through AI and low-code interfaces, making sophisticated approaches accessible.

Q3: How can AI platforms like InvestGo help my trading strategy in 2026?

A3: In 2026, AI platforms like InvestGo automate complex analysis, identify patterns, and define AI investment personas. InvestGo's transparent technology provides clear reasoning behind trades.

Q4: Are free stock analysis websites reliable for serious trading?

A4: Free websites offer excellent foundational data and tools. However, for highly advanced strategies, paid versions may offer deeper insights or faster data feeds. Always cross-reference information and understand limitations.

Q5: What are the key differences between analyzing stocks for short-term vs. long-term trading?

A5: Short-term trading focuses on technical indicators and price action, requiring real-time data. Long-term trading emphasizes fundamental analysis and macroeconomic trends, using broader financial data.

Conclusion

In 2026, crafting a winning trading strategy is no longer a privilege reserved for coders; it's within reach for everyone. By expertly utilizing the best free stock analysis websites, you can effectively build your trading strategy without Python, unlocking powerful insights without hefty costs. These platforms democratize access to crucial data, empowering informed decision-making.

To translate this knowledge into action, begin by exploring the recommended free resources and clearly defining your personal trading objectives. Experiment with various strategies, embracing both traditional analysis and innovative AI tools like InvestGo to refine your approach. Remember, continuous learning and robust risk management are paramount.

The journey to a successful 2026 trading strategy starts now, and the tools are more accessible than ever before. Don't delay – begin building your personalized trading plan today and seize the opportunities that await!