Navigating HYMLF: Hyundai Motor Company's Financial Landscape with InvestGo

In the ever-shifting currents of global finance, staying ahead requires more than just a keen eye; it demands sophisticated tools to dissect company performance and make informed investment decisions. For those charting a course through the automotive sector, the financial narrative of Hyundai Motor Company, often accessed through instruments like HYMLF, offers a fascinating and potentially rewarding exploration. Are you ready to unlock the insights that drive success in this dynamic market? This article is your compass, guiding you through the intricate financial landscape of Hyundai Motor Company. We'll not only assess its current standing but also introduce you to InvestGo, a groundbreaking AI-powered asset management platform. Discover how InvestGo's innovative features can empower your analysis and potential investment in HYMLF, paving the way for your own intelligent investing journey.

In the ever-shifting currents of global finance, staying ahead requires more than just a keen eye; it demands sophisticated tools to dissect company performance and make informed investment decisions. For those charting a course through the automotive sector, the financial narrative of Hyundai Motor Company, often accessed through instruments like HYMLF, offers a fascinating and potentially rewarding exploration. Are you ready to unlock the insights that drive success in this dynamic market? This article is your compass, guiding you through the intricate financial landscape of Hyundai Motor Company. We'll not only assess its current standing but also introduce you to InvestGo, a groundbreaking AI-powered asset management platform. Discover how InvestGo's innovative features can empower your analysis and potential investment in HYMLF, paving the way for your own intelligent investing journey.

Understanding HYMLF: A Deep Dive into Hyundai Motor Company's Financial Standing

This section explores the financial landscape of Hyundai Motor Company, focusing on its market position and the implications for its financial instruments, such as HYMLF. As a prominent player in the global automotive industry, understanding Hyundai's performance is crucial for investors and stakeholders.

Hyundai Motor Company: A Global Automotive Powerhouse

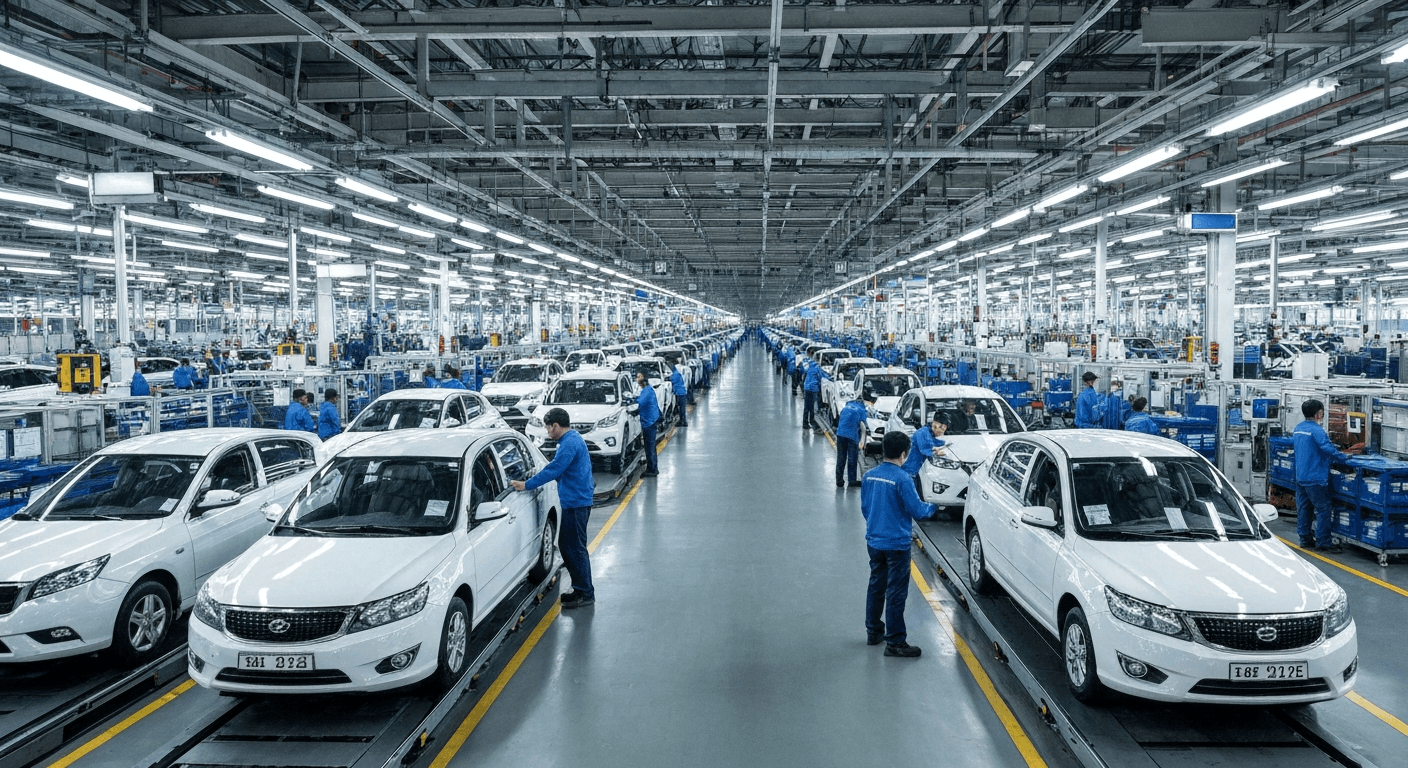

Hyundai Motor Company boasts a rich history and a significant global footprint, recognized for its diverse product portfolio ranging from fuel-efficient sedans to robust SUVs and innovative electric vehicles. The company's extensive manufacturing and distribution networks span across continents, underscoring its status as a major automotive powerhouse. This global presence allows Hyundai to tap into various markets and adapt to regional demands.

Introducing HYMLF: The Financial Instrument

In the context of Hyundai Motor Company's financial structure, HYMLF represents its stock traded on the Pink Sheets (PINX) exchange. As a publicly traded equity, HYMLF offers investors a stake in the company's performance and future growth. The stock price of HYMLF, along with related news, valuation data, and dividend information, are key indicators for those looking to make informed investment decisions. Platforms like Morningstar provide comprehensive resources to analyze these aspects.

Key Financial Metrics and Performance Indicators

Analyzing Hyundai Motor Company's financial health involves scrutinizing key metrics. While specific real-time data for HYMLF would be found on financial platforms, general indicators of a company's standing include revenue generation, profit margins, the level of debt the company carries, and its cash flow. These figures provide insights into operational efficiency, profitability, and financial stability. For instance, consistent revenue growth and healthy profit margins suggest strong market demand and effective cost management.

Market Position and Competitive Landscape

Hyundai Motor Company operates in a highly competitive automotive market, facing rivals from both established global manufacturers and emerging players. Its market share is influenced by factors such as product innovation, pricing strategies, brand perception, and its ability to navigate global economic trends and shifts within the automotive industry, such as the rapid transition to electric vehicles. Strategic advantages for Hyundai often lie in its commitment to technological advancement and its broad range of offerings designed to appeal to a wide consumer base. The performance of HYMLF is intrinsically linked to how well the company maintains and expands its competitive edge in this dynamic environment.

Navigating Investment with InvestGo: A Modern Approach to Asset Management

The investment landscape is undergoing a profound transformation, particularly for emerging generations like Gen Z and technically adept developers. Gone are the days of solely manual trading; a new paradigm is emerging where sophisticated AI tools are not just aids but active participants. InvestGo positions itself at the forefront of this evolution, offering a unique platform for managing AI-driven fund managers. This shift empowers individuals to transition from active traders to strategic asset allocators, overseeing a suite of intelligent agents rather than executing trades themselves. For instance, an investor interested in the performance of Hyundai Motor Company (HYMLF) might leverage InvestGo to manage an AI that actively monitors and adjusts positions based on real-time market data and company news, rather than manually tracking every fluctuation.

InvestGo's Core Philosophy: Programmable AI Asset Management

InvestGo's core philosophy is rooted in the concept of programmable AI asset management, designed for the agentic AI era. Users are no longer hands-on traders but rather Limited Partners (LPs) who orchestrate and manage a portfolio of AI fund managers. This approach redefines the role of the investor, shifting focus from micro-level execution to macro-level strategy and oversight. The platform provides a powerful, yet intuitive, environment for this new breed of asset management.

The Strategy Canvas: Crafting AI Investment Personas and Policies

At the heart of InvestGo lies its innovative "Strategy Canvas." This low-code orchestration platform, reminiscent of tools like n8n, allows users to define AI investment personas and policies through natural language prompts. Imagine crafting an AI fund manager by simply stating, "You are a value investor focused on dividend-paying stocks with a strong balance sheet, prioritizing companies like Hyundai Motor Company (HYMLF) for their long-term stability." The canvas enables users to connect various data modules, such as market scanners and macroeconomic feeds, to provide these AI agents with the necessary intelligence. This "Prompt-as-Strategy" approach democratizes sophisticated investment management, making it accessible without deep coding expertise.

White-Box Thinking Chain: Transparency in AI Decision-Making

A critical differentiator for InvestGo is its proprietary "White-Box Thinking Chain" technology. Unlike traditional "black-box" investment approaches where AI decision-making processes are opaque, InvestGo makes the AI's investment logic transparent and understandable. Every buy or sell decision is accompanied by a clear, traceable chain of reasoning. This means an investor can understand precisely why an AI decided to allocate capital to, or divest from, a particular asset, such as Hyundai Motor Company (HYMLF). This unprecedented transparency builds trust and allows users to refine their AI strategies with greater confidence, fostering a deeper understanding of quantitative investment principles.

The Evolving Investor: From Trader to Asset Allocator

The investment landscape is evolving, pushing individuals to transition from active traders to strategic asset allocators. This shift is driven by the increasing availability and sophistication of AI tools. Instead of manually executing trades, investors can now oversee and manage AI agents that handle the day-to-day operations.

Practical Implications:

Actionable Tips:

1. Familiarize Yourself with AI Platforms: Explore platforms like InvestGo to understand how AI can be leveraged for asset management.

2. Develop Strategic Oversight Skills: Focus on defining clear investment goals and risk parameters for your AI agents, rather than getting lost in the details of individual trades.

Leveraging InvestGo's Features for HYMLF Analysis and Investment

InvestGo empowers investors to navigate the complexities of assets like Hyundai Motor Company's HYMLF with a sophisticated, programmable AI asset management platform. Designed for Gen Z, developers, and quant enthusiasts, InvestGo shifts the user from manual trader to strategic asset allocator, managing a suite of AI agents. This platform's core innovation lies in its transparent "white-box thinking chain technology," making AI decision-making visible and understandable, transforming the opaque investment black box into a visualized logic art.

Virtual Exchange Node: Backtesting and Live Trading Capabilities

The Virtual Exchange Node is the crucial bridge between AI decision-making and actual asset management. It operates in a dual-mode functionality, offering both a robust backtesting/debugging mode and a continuous live/simulation mode. In backtesting, each run resets capital and historical data, allowing for meticulous refinement of AI prompts and strategies, akin to debugging code. This is invaluable for testing hypothetical investment approaches for HYMLF without real-world risk. Conversely, the live/simulation mode supports persistent capital states and 7x24 hour continuous operation. This enables real-time market monitoring and execution, ensuring that strategies for HYMLF can adapt instantly to market shifts or capitalize on fleeting opportunities.

Modular Perception: Integrating Market Data and Macroeconomic Flows

InvestGo’s strength lies in its modular design, allowing for a comprehensive understanding of market dynamics relevant to HYMLF. The platform’s modular perception components can seamlessly feed real-time market data, including price movements, trading volumes, and technical indicators specific to Hyundai Motor Company. Furthermore, it integrates crucial macroeconomic indicators such as interest rates, inflation data, and global economic forecasts that can significantly influence automotive sector performance and, by extension, HYMLF. This holistic data ingestion ensures that AI decision-making is grounded in both granular asset-level information and broader economic trends.

One Brain Architecture: Centralized AI Decision-Making

A key differentiator for InvestGo is its 'One Brain Architecture'. This design principle ensures that each AI workflow is anchored to a single, dedicated AI model acting as the central decision-making hub. This approach is critical for HYMLF investments, as it eliminates the risk of conflicting AI recommendations that can arise from multiple independent agents. By centralizing the AI's "mind," InvestGo guarantees a coherent and unified investment strategy, preventing the kind of disjointed or contradictory actions that could jeopardize portfolio performance.

Practical Applications: Simulating HYMLF Scenarios

An investor looking to analyze HYMLF could leverage InvestGo in several practical ways. For instance, they might define an AI persona as a cautious investor focused on dividend yields and long-term growth, then use the Virtual Exchange Node in backtesting mode to simulate how this strategy would have performed against historical HYMLF data. Alternatively, an investor could simulate potential outcomes by feeding projected economic scenarios into the platform's macroeconomic data flows, observing how the AI would adjust its HYMLF holdings in response to simulated market downturns or upturns. The benefits of continuous operation in live mode are substantial for real-time market monitoring, allowing for immediate adjustments to HYMLF investment strategies as news or market conditions evolve.

Strategic Considerations for Investing in HYMLF

Investing in Hyundai Motor Company's HYMLF (Hyundai Motor Company, HYMLF) stock requires a strategic approach, considering various factors to optimize potential returns and manage risks. This section outlines key considerations for investors looking to navigate the HYMLF landscape.

Risk Management and Diversification

A fundamental principle for any investment, including HYMLF, is robust risk management. This involves understanding that all stock investments carry inherent risks, from market volatility to company-specific challenges. Diversification remains paramount; spreading investments across different asset classes, industries, and geographies can mitigate the impact of any single investment's poor performance on the overall portfolio. While HYMLF represents an opportunity within the automotive sector, it should not constitute the entirety of an investor's holdings.

Long-Term vs. Short-Term Investment Horizons

The suitability of HYMLF for long-term growth or short-term trading depends on an investor's objectives and risk tolerance. For those seeking capital appreciation driven by Hyundai Motor Company's innovation, global expansion, and evolving product lines (e.g., electric vehicle development), a long-term horizon is often more appropriate. Conversely, short-term traders might focus on technical analysis and market sentiment surrounding HYMLF, aiming to capitalize on price fluctuations. However, the inherent volatility of the automotive market may favor a longer-term perspective for sustained growth.

The Role of AI in Mitigating Volatility

Platforms like InvestGo, with their programmable AI asset management capabilities, can play a significant role in managing risks associated with HYMLF. InvestGo's AI can analyze market trends, macroeconomic indicators, and company-specific news impacting Hyundai Motor Company. By employing "white-box thinking chain technology," investors can gain transparency into the AI's decision-making process, understanding why trades are executed. This AI-driven approach can help identify potential downturns or react to unexpected news, potentially mitigating losses and optimizing trading strategies for HYMLF.

Regulatory Landscape and Compliance

Investors in the US market must be aware of the relevant financial regulations governing stock trading. This includes understanding reporting requirements, tax implications, and the rules set by bodies like the Securities and Exchange Commission (SEC). Compliance ensures that investments in HYMLF are conducted legally and ethically. Staying informed about any regulatory changes that might affect the automotive industry or foreign stock investments is crucial for maintaining a compliant portfolio.

A critical aspect of a successful HYMLF investment strategy is staying abreast of Hyundai Motor Company's future plans and the broader industry trends impacting the automotive sector. This includes monitoring advancements in electric vehicles, autonomous driving technology, and shifts in consumer preferences. Such insights are vital for anticipating future performance and making informed investment decisions regarding HYMLF.

The Future of Investing in Automotive Stocks with AI

The Growing Influence of AI in Finance

AI is revolutionizing investment strategies by enhancing data analysis and decision-making. Platforms like InvestGo, a programmable AI asset management solution, empower users to act as "asset allocators" managing AI fund managers. This shift moves beyond manual trading to a more sophisticated, AI-driven approach.

Hyundai's Future Outlook and Potential Impact on HYMLF

Hyundai Motor Company's focus on EVs and autonomous driving presents significant growth potential, which could positively influence HYMLF's performance. While specific future projections are speculative, these technological advancements are key drivers for the automotive sector.

Empowering the Modern Investor

InvestGo's low-code strategy canvas and transparent "white-box thinking chain" technology allow users to define AI investment personalities and strategies through natural language. This empowers individual investors with advanced tools for informed decision-making.

FAQ (Frequently Asked Questions)

Q1: What is HYMLF and how does it relate to Hyundai Motor Company?

A1: HYMLF is the stock ticker symbol for Hyundai Motor Company traded on the Pink Sheets (PINX) exchange. It represents an equity stake in the company, allowing investors to participate in its financial performance and growth.

Q2: How can InvestGo help with investing in HYMLF?

A2: InvestGo provides an AI-powered asset management platform that enables users to create and manage AI fund managers. This allows for sophisticated analysis of assets like HYMLF, automated trading strategies, and transparent decision-making processes, moving investors from active traders to strategic asset allocators.

Q3: What are the benefits of InvestGo's "White-Box Thinking Chain" technology?

A3: The "White-Box Thinking Chain" technology makes the AI's investment decision-making process transparent and understandable. This allows investors to see the exact reasoning behind every trade, building trust and enabling them to refine their AI strategies with greater confidence.

Q4: Is InvestGo suitable for beginners in investing?

A4: While InvestGo offers advanced AI capabilities, its low-code Strategy Canvas and natural language prompt system are designed to make sophisticated investment management accessible. It empowers users to define AI investment personas and policies without requiring deep coding expertise, making it a powerful tool for both experienced and emerging investors.

Conclusion

In conclusion, the financial landscape of Hyundai Motor Company, particularly through the lens of HYMLF, presents a compelling horizon for discerning investors. This journey, far from being a passive endeavor, transforms into an active pursuit of financial growth by leveraging the cutting-edge capabilities of InvestGo. By moving beyond conventional investment strategies, investors can harness the power of AI-driven fund management, facilitated by InvestGo's transparent and programmable framework. The 'white-box thinking chain' ensures an unparalleled level of clarity, empowering users to understand the rationale behind every allocation. Furthermore, the Strategy Canvas and Virtual Exchange Node provide the essential tools to not only conceptualize but also execute sophisticated investment strategies within the dynamic automotive sector and beyond.

For those seeking to capitalize on the opportunities presented by Hyundai Motor Company and HYMLF, the path forward is clear: embrace innovation. We urge you to explore InvestGo today and discover how its advanced AI capabilities can empower you to become a strategic asset allocator. By integrating a deep understanding of HYMLF's financial intricacies with InvestGo's sophisticated platform, you are not just investing; you are building a future of informed, data-driven financial success. Take the first step towards optimizing your investment portfolio and navigating the future of finance with confidence. Visit InvestGo now to unlock your potential.